I am interested in purchasing my next home and I would like to see more about how the purchase loan process works.

I am interested in refinancing my mortgage and I would like to see more about how the refinance process works.

Why our exclusive Winner’s Mortgage Program is so different than any other mortgage company

And why you simply cannot afford to work with just any typical run-of-the-mill loan officer …

For your home purchase or for your mortgage refinance …

Discover how you can WIN with the Winner’s Mortgage Program, not lose like most people lose …

You really can WIN with your mortgage!

I’m Harvey Bernard and I’m here to share a totally different approach on how you can WIN with your mortgage, instead of losing, which is what most people do. And most people probably don’t even know that they are losing.

To make this possible for you, I have developed the Winner’s Mortgage Program.

And I’m here to tell you that if you’ve lost with your mortgage in the past, it’s not your fault.

And if you’ve thought that you could never WIN with your mortgage, I want you to know that it does not have to be that way. You can WIN with your mortgage, and WIN big!

The problem is that banks and lenders, the government, and your employer don’t want you to WIN with your mortgage. Because when you WIN with your mortgage, you can be free of them, and they need you to be dependent on them.

They want you to think that you can never be free of loan payments, or free of your job, or free to do what you want.

If you have ever thought that banks and lenders, the government, and your employer want you to fail, you’re probably right.

The Winner’s Mortgage Program is how you can get the right mortgage without getting ripped off! And how you can WIN with your mortgage!

One of the most common financial transactions today

We’re going to talk about one of the most common financial transactions today.

It is also one of the least understood financial transactions, and it has huge power to break you financially and keep you poor.

The problem is that most people get ripped off with their mortgage. They lose.

But if you handle it correctly, you can also WIN with your mortgage, and you can WIN financially, but sadly only a small handful of people ever experience winning with their mortgage.

Even the word “mortgage” tells us just how much power it has to break you if you let it break you. But when you take control, you can WIN!

Do you remember how schools used to teach how you can break down a word into its origin meaning?

What the word “mortgage” really means

Do you know what the word “mortgage” means if you break it down to its original meaning?

“Mortgage” comes from Latin, meaning “mortuus”, which then became Old French “mort”, meaning “death” …

And from Old French “gage”, meaning “pledge”.

So, a mortgage is a “Death Pledge” !

Isn’t it true?!

Isn’t that exactly what happens when you have to make mortgage payments?

I’ve been there, and I know what happens

I’ve been there, and I learned the hard way through my experience with loans and mortgages.

The government, lenders, and your employer don’t want you to know the truth about mortgages.

They need you in bondage to those mortgage payments, and they need you in bondage to them.

The truth is, the truth that they won’t tell you, is that as long as you have a mortgage, it is a death pledge!

And you need to think of it that way.

And I’ve been there and I know how much of a death pledge mortgages can be.

Back when I learned this the really hard way, I had two houses, each was a duplex, so that made a total of four apartments in two houses. I was living in one of the apartments and renting out the other three.

By the way, this is a really good way to buy and own real estate if it’s something you want to do.

But, unfortunately, because of the challenges I was having in my business, I was having trouble making the payments.

And I learned the really hard way that lenders don’t like it when you don’t make the payments. To make this situation even worse, this was in a small town, and the lender for both houses was the small town bank, and the banker was a former classmate in high school.

So, it turned into a really tough situation. Bankers act like such nice friendly people when they are trying to entice you to be in debt to them, and to put your money in their bank.

But when you don’t make the payments, they turn around and become really nasty. I had to get an awesome creative attorney to work out a solution to all of that.

It was a really tough situation for me. For them, it was just another day in the life of being a bank, no big deal to them. But to me, it was totally emotionally draining and made a huge impact on my life – such a huge impact that it changed the direction of my life so that I now I want to make sure that I can do anything possible to keep other people from experiencing what I had to go through.

I am interested in purchasing my next home and I would like to see more about how the purchase loan process works.

I am interested in refinancing my mortgage and I would like to see more about how the refinance process works.

You can learn the truth

You will learn the truth today about mortgages that no one has been telling you.

If you don’t already have a mortgage, you’re in a great spot, you will learn how you can get your mortgage without getting ripped off.

If you already have a mortgage, you will learn how you can stop getting ripped off.

Either way, you are in a great place here and you can learn so much.

Here is my first goal for today, that you know the truth …

Loans and mortgages, and the payments that go with them, are promoted as the way you should live . . .

I believed it myself before I learned the truth

But in reality, they keep you a slave to …

Banks and lenders, and the government, and to your job, as long as you have to make those payments …

I believed what society was telling me, and I learned the good news the really hard way …

And the good news is that the same money you give to lenders as loan payments …

That same money can actually make you free …

You can be free of loan payments …

Then you can be free of your job …

And you can be free to do what you want.

You just need to know it is possible,

You need to know how to do it,

And then you need to take action and actually do it!

When you do, you will find that your life will be simply awesome, and you will be so happy you did it!

I experienced The Hard Way, the really hard way …

From my really hard experience with lenders…

I know what happens when you get your mortgage, and when you have loan payments …

I know how lenders and society are working against you …

I know how expensive it is to have loan payments …

I know how hard it is to work for lenders instead of for yourself …

I know how hard it is to work for money instead of having money work for you …

Now I know what to do about it, how to free you from that bondage

It all starts with your mortgage …

And making sure you get the right mortgage that does not rip you off.

How can I use my experience for your good?

One thought consumed me.

How could I use this experience for good?

How could I tell people about the lies society is telling us about borrowing money?

How could I let people know that having loan payments is not good for them?

How could I share my experience in a positive way to truly help people?

This became my passion, my mission. This very negative experience with borrowing money motivated me to research how it could be different.

That’s when I discovered a little-known, but proven system to be completely free of all loan payments quickly, often in just a few years, instead of 30 years or more, like with mortgage payments.

I was amazed. How could it be possible? The culture teaches the exact opposite, that you should expect to make loan payments your whole life.

But as I researched it, checked it, and rechecked it again, it was true.

Really true!

And then I added to that a system to be free of your job, and free to do what you want.

At that point, everything changed!

Money could now work for people, instead of their having to work for money.

So powerful!

Just by learning what to do, by making their own personal plan according to the system I had discovered, and by faithfully following it.

True financial freedom could be a reality for so many people.

The freedom to have only one spouse working if they wanted, not two.

The freedom to get out of the rat race and off the treadmill.

The freedom to work from home if they wanted.

The freedom to do what they wanted to do, not what they had to do.

The freedom to keep more of their money for themselves, instead of giving it away to creditors and the government.

The freedom to never make loan payments ever again.

This was the passion and the mission that could help so many people.

This is the good that would come from my very negative experience with loans.

But the problem was that not enough people were learning this system – and typical run-of-the-mill mortgage loan officers were getting people into the life-sucking 30 years or more of mortgage payments – payments that were simply sucking the financial life right out of them.

Payments that were making lenders wealthy, and keeping people poor.

My problem was, how do I beat this system? How do I get people into the right mortgage, and into a system that they could WIN with their mortgage, and not lose to the lenders and the culture?

I am interested in purchasing my next home and I would like to see more about how the purchase loan process works.

I am interested in refinancing my mortgage and I would like to see more about how the refinance process works.

One major truth

As I studied it and created my system, I realized one inescapable truth – a truth that most people don’t even think about – a truth that the government, lenders, and your employer don’t want you to know.

Your mortgage, and the interest you pay on that mortgage, is the single biggest category of expenses in your life over which you have direct control.

It may not seem like you have direct control over your mortgage, but you really do.

Your home financing is the biggest loan burden you will probably take on in your lifetime.

Yet, when I asked in my previous seminars and webinars how many people really understood what they were doing when they received their mortgage financing, hardly anyone says ‘yes’.

This tells me that most people hope they are making the right decisions, but they don’t really know for sure.

The mortgage is the biggest loan burden you will probably ever take on …

and it can have such a huge impact on your ability to become free of all loans and financially independent,

You must understand this huge burden of loan payments that you take on – a burden that can break you and keep you poor if you don’t know what to do.

This is why I created the Winner’s Mortgage Program and the Winner’s Mortgage Master Plan – to keep you from getting ripped off on your mortgage – so that you can WIN with your mortgage, and stop losing.

This is the result of many years of effort, many all night sessions 12 am to 6 am.

I have done this so that you can have the Winner’s Mortgage Program and the Winner’s Mortgage Master Plan.

I want you to WIN, not lose like I did

This is my passion, to be free of loan payments, free of a job, and free to do what I want …

This is how I can bring a huge value to so many people.

And my passion is to help you do it too.

I’ve been there and I don’t want you to be there …

I want you to WIN, not lose like I did …

I went through all the misery to figure this out, and because you are here today, you have the opportunity to skip all the misery …

You can go straight to WINNING, and skip losing …

Do you want to start WINNING?

You’ve been doing it the wrong way

If you’ve been struggling, this is probably why …

You’ve been doing it the hard way …

You have been losing, not WINNING …

But it’s not your fault …

You’ve just been doing what other people do, what the culture, advertisers, the media, and lenders tell you to do. You haven’t known any better until today.

If you’ve been concerned that you just can’t WIN with your mortgage, I want to put those fears to rest. You can do this. You just need the right person to explain it to you.

The culture, advertisers, the media and lenders want you to think that having loan payments is the only way to live, and they want you to think that you can be successful that way.

But that’s how they get rich and keep you poor. That’s how they WIN and you lose. That’s why they want you to think so, but it’s not true.

If you’ve ever thought that the culture, advertisers, the media, and lenders actually want you to lose, you’re probably right. They don’t benefit when you WIN. They want to keep you in bondage to them.

My difference is that I actually care about your WINNING and truly want you to be free from loan payments, free from your job, and free to do what you want. I want you to WIN because I have experienced losing and I know from cold, hard experience that it is no way to live.

So, that’s what the Winner’s Mortgage Program is for.

I believe you have a dream to be free, that you want to make a difference and impact in the world, and I want to show you how you can be free and make that happen.

It is only when you are free that you can make your dreams come true to have that kind of impact on the world. When you are in bondage to loan payments and your job, you are making someone else’s dreams come true, not yours.

I want your dreams to come true.

I am interested in purchasing my next home and I would like to see more about how the purchase loan process works.

I am interested in refinancing my mortgage and I would like to see more about how the refinance process works.

How you are getting ripped off

The hard way to live

Let’s start by explaining how you are getting ripped off. Here is what happens to the people who lose.

Do you realize that if you think about it the right way, that you are actually a millionaire?

Think about this . . .

When you earn at least $25,000 per year and you work for 40 years, you earn at least $1,000,000 in your lifetime – and many people earn much more than a million dollars.

So where is it?

You earn it, why don’t you have it?

Where does it go? What happens to the million dollars you earn?

Taxes

What do you think is the biggest category of expenses we have?

Most people will say the mortgage, but it’s not. It’s something bigger.

It’s taxes. Taxes is the single biggest category of expenses we have.

In fact, taxes take an average of about one-third of our income.

So, here is the million dollars that we earn in our lifetime.

Take taxes right off the top of our income, much of it in withholding before we ever get to see the money, and this is how much we have taken away from us.

Taxes take about one-third of our income right off the top. Here is what it looks like.

And here is what is left after the taxes are gone.

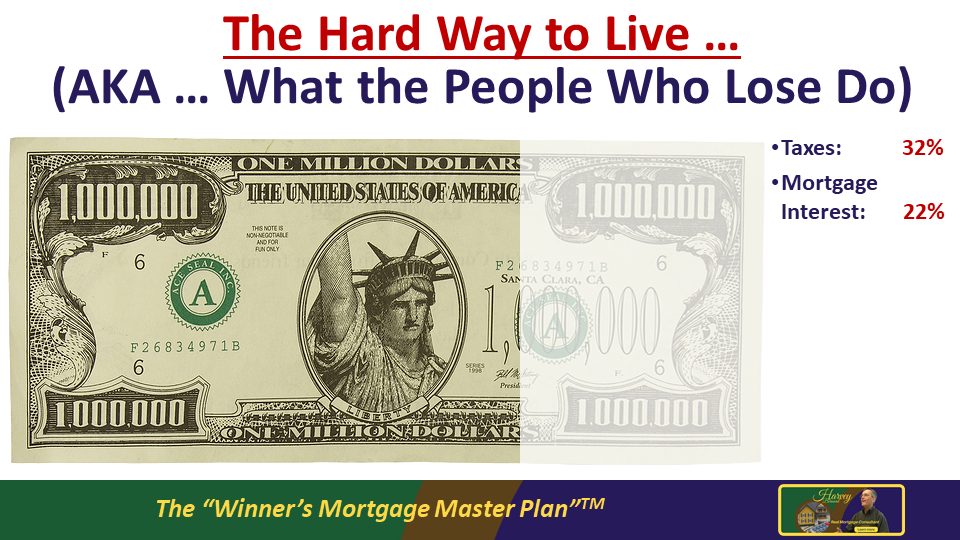

Mortgage interest

So, what is the next largest expense?

It’s the mortgage interest on the mortgage loan payments we make.

Here is the mortgage interest paid by a typical household.

That is about 22% of a typical family’s income.

So, now look at where we’re at. We are down to less than half of our lifetime income left, and all we’ve done are two things.

We’ve paid taxes and we’ve paid the interest on the mortgage. Remember, the actual price of the house is in the part that is still left here.

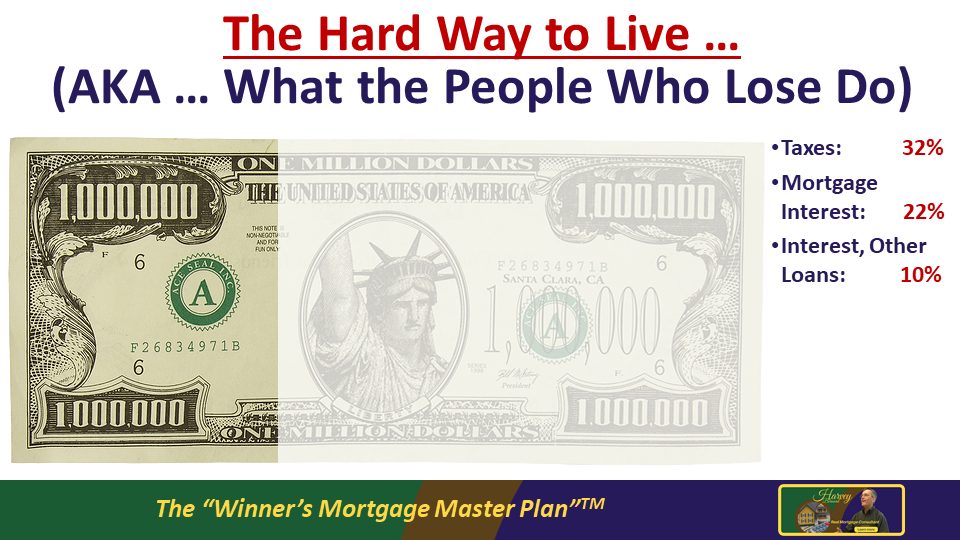

Interest on other loans

Then we still have the interest on all the other loan payments, such as car loans, credit cards, student loans, and any other loans they can get us to take on.

This can be about 10% of a typical family’s income.

And here is what is left.

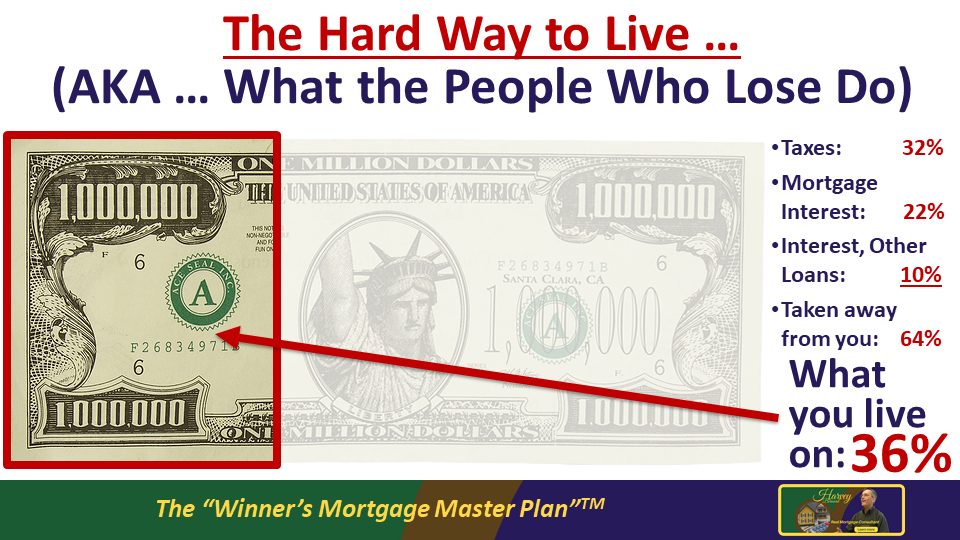

Don’t end up losing

People are getting ripped off so that all they have left is this little bit to live on. They do the work, and others get wealthy.

What is this money for? This is the money the typical family lives on. This goes for everything a family needs and wants – food, clothing, transportation, everything, including the actual price of the house.

This is the hard way. It’s a tough way to live, and it’s what society says is normal.

But it does not have to be normal. There is a much better way.

You can keep much more of your money, the money you work for, and you can WIN!

The Winner’s Mortgage Program is the beginning of the difference for you

Whether you are buying your next home and you will go through our purchase loan process …

Or you are refinancing your current mortgage and you will go through our refinance loan process …

You simply can’t afford to do your mortgage any other way …

You will WIN with our Winner’s Mortgage Program …

Go to any typical run-of-the-mill loan officer, and you have the very real possibility that you will lose …

And you may not even know you are losing, even though you are losing.

Choose either the purchase or refinance button below to learn more about our exclusive Winner’s Mortgage Program loan process.

I am interested in purchasing my next home and I would like to see more about how the purchase loan process works.

I am interested in refinancing my mortgage and I would like to see more about how the refinance process works.