Good people with bad credit who want to buy or refinance their homes.

What happens if you have bad credit and you want to buy your next home or refinance your current mortgage?

What can you do?

Good people with bad credit may be able to get mortgage financing more easily than they think. Or in some cases, it may be a problem, and better to wait while they work on the situation.

Each person’s circumstances will be different. Each situation requires a personal approach.

The good news is that there are options …

Options to get the mortgage financing now or options to work on your situation and do it soon.

Either way, talk to us and our crack team of pros.

Your fully-trained Real Mortgage Consultant will work with you to get the best financing now.

Or your Real Mortgage Consultant will coach you through the process. The goal is for you to get your mortgage financing as soon as possible. And we have a formula for success!

What is bad credit?

Your credit history will be a combination of two primary factors.

Credit score

A higher credit score is better. Depending on the lender and program, lower scores are bad credit. Different lenders have different guidelines on what a bad credit score means.

Mortgage scores range from 300 – 850. Not everyone agrees on exactly where the divisions are between credit labels. These are generally called poor, fair, good, very good, and excellent credit.

Also, lenders vary on what credit scores they are willing to consider for approval. Additionally, higher scores will result in lower interest rates.

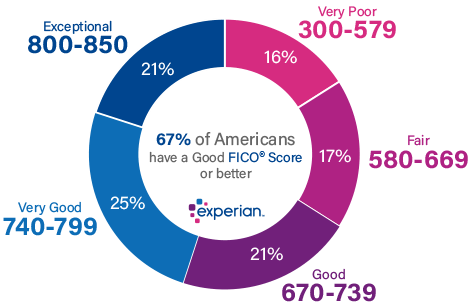

Experian is one of the major credit bureaus. They report their study of how many Americans have varying FICO® scores. They show that 67% of Americans have good credit, 670 or above.

Credit scores are calculated as a combination of these five factors.

· Payment history. Have you made your loan payments on time? On-time is better.

· Amount owed. How much do you owe as a percentage of your maximum credit limit? Lower is better.

· Length of credit history. How long have your existing accounts been open? Longer is better.

· Types of credit. Do you have more installment loans? This includes a mortgage or car loan with defined monthly payments)? Or do you have more revolving accounts? This includes credit cards with variable payments. More installment and less revolving are better.

· New credit. How many recent credit inquiries do you have? Fewer is better.

Negative major public records are bad credit, some of them are worse than others.

Negative major public records will pull down credit scores. They may also hurt your ability to get approved for certain loan programs. This effect will last for a specified period of time regardless of your credit score.

These are examples of negative major public records that can hurt your credit. Chapter 7 bankruptcy. Chapter 13 bankruptcy. Mortgage foreclosure. Court judgments. Tax liens.

How much can bad credit cost on your mortgage?

If you do get a mortgage loan with bad credit, expect that it will be more expensive.

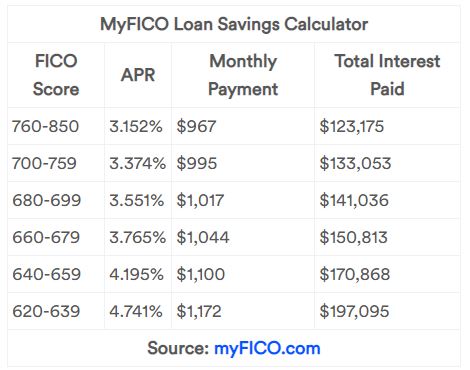

Bankrate reports the result of a study they did using the loan savings calculator on myFICO.

Use their example of a $220,000 loan at a 30-year fixed market interest rate of 4.87% in November 2019. This is according to Freddie Mac, here is what they found at various FICO score levels.

The difference in payment alone between the top FICO score range and the lowest is $205 per month. It translates into an extra $73,920 interest over the loan term. That is a significant amount.

It means that you want to be very smart about how to proceed with bad credit. Does it make sense to go ahead and get a mortgage loan anyway if you can, or is it better to improve your credit first, then proceed?

This is a question that will be personal for you depending on your circumstances and goals. Let your dependable Real Mortgage Consultant help you. Be in control of your success. Together you will think through your options so you can develop a great plan for you.

What does it mean for your possibilities of approval with bad credit?

Different lenders and loan programs have different standards for what they will approve. Each situation is different, and lending guidelines change over time.

Again, the best answer is to work with your professional Real Mortgage Consultant. Together you will analyze your individual situation. Then you can determine what is available for you and tailored to your needs.

Not all lenders will provide loans to bad credit customers. They are not willing to take the extra risk.

Loan programs that could be possible for bad credit

Here is a selection of loan programs that could work for your home purchase or refinance. They can apply even with bad credit.

Fannie Mae Home Ready & Freddie Mac Home Possible programs

A 3% down payment is possible for both programs.

The Fannie Mae program will go down to a score of 620, Freddie Mac to 660.

They need private mortgage insurance. Higher premiums will apply for lower scores.

Recent foreclosures and bankruptcies will not work for these programs.

FHA Loans

The Federal Housing Administration backs FHA loans. They are used only for a primary residence.

The program will go down to a 580 score for a 3.5% down payment. A 10% down payment will work to a 500 credit score.

FHA loans have a one-time Upfront Mortgage Insurance Premium paid at closing. This can be included in the loan amount, plus monthly Mortgage Insurance Premiums.

Recent foreclosures and bankruptcies will not work for 2-3 years. Judgments and tax liens can qualify if they are being repaid.

VA Loans

The Department of Veterans Affairs (VA) offers these loans. Past and current service members, veterans, and eligible spouses can use this program.

They do not have a specific minimum score, but many lenders will go to around 620.

VA will do loans with no need for a down payment.

VA loans have an upfront funding fee, but they do not have monthly mortgage insurance.

Foreclosures and bankruptcies must be older than 2 years. Judgments and tax liens can qualify if they are being repaid.

USDA Loans

The U.S. Department of Agriculture insures mortgages by approved lenders. USDA loans only apply for properties in specific rural and suburban areas.

They do not have a specific minimum score. A score of 640 or above is best, although exceptions can be available down to 581.

USDA will do qualifying loans with no down payment needed.

USDA loans have an upfront guarantee fee, plus a monthly fee as well.

Recent foreclosures and bankruptcies will not work for 2-3 years. Judgments and tax liens can qualify if they are being repaid.

Non-qualified mortgage loans

The loan programs listed above are all classified as “Qualified Mortgages”. This means that lenders have to prove that the customer has the ability to repay the loan.

Non-Qualified mortgage loans have more flexibility for higher-risk borrowers. This means that lower credit scores can be an option.

These mortgages will often need higher down payments. They come with higher interest rates.

They may be appropriate in specific situations. To determine this, work with your experienced Real Mortgage Consultant. Together you can determine the options available for your situation. We’re there when you need us!

Improving your mortgage approval chances with bad credit

What can you do to improve your mortgage approval chances if you have bad credit?

It starts with doing everything you can to improve your credit record.

Let your recognized Real Mortgage Consultant be part of this process. Start there and together you can work out a plan. You expect the best. We demand it!

Your plan could include some or all of the following ideas.

Check your credit report at AnnualCreditReport.com.

This is a free site made available by the government so that you can see the listings on your credit report.

A study by the Federal Trade Commission showed that five percent of consumers had errors on the credit report. That could mean they received less favorable loan terms.

Additionally, up to 20-25% had incorrect information.

It pays to contest credit errors. The study showed that 80% of people received adjustments to their records.

This means that the potential for errors is high. It is well worth checking. There is a possibility to improve your credit score.

Know where your spending goes.

It’s critical that you make a plan. Be sure that you send payments where they do you the most good, and that you pay on time.

Save money.

The more money you can save the better. Available cash will help you get through emergencies. It is also necessary for purchasing your next home.

Understand your credit score.

Know the five major factors that go into calculating your credit score. This gives you the power to control these factors better. You can then act in ways that can improve your score.

Reduce your debt-to-income ratio (DTI)

Do everything possible to pay off debts. This will reduce your debt-to-income ratio. The lower your DTI the more likely the lender will approve your loan.

You can also reduce your DTI if you can increase your income.

Only certain types of income will count with the lender right away. It needs to be a salary or wages within the parameters of a normal 40-hour workweek.

Overtime, part-time income, and self-employment income all need a two-year history. The lender will not count it until you have done it for two years.

Even if the lender does not give you credit for it now, that income still produces cash. You can use that cash to reduce your debts which will also reduce your DTI. It’s real cash you can use even if the lender does not count it in your favor now.

Be hyper-focused to make all your payments on time

Make a list, a spreadsheet, or some way that you can track all the payments you need to make each month. As you are rebuilding your credit, do not miss any due dates.

Work with your accomplished Real Mortgage Consultant with Winner’s Mortgage. You receive access to our exclusive information to help you. You get all the facts. That is part of our hard-hitting Winner’s Mortgage Master Plan. Our Loan Payment Freedom Secrets Master Class module is especially useful.

This will help you get set up for approval. It is a great reason why you want to start this process with your credible Real Mortgage Consultant. We have a formula for success! Together you make it happen for your success.

You may need professional credit repair services

You can do most or all credit repair yourself.

You may find that it will be more efficient and effective to have help. Consider enlisting the services of a credit repair specialist company.

If this is the best action for you to take, your professional Real Mortgage Consultant can set you up with a great company.

This is important because there are so many bad companies out there. You need to be so careful who you choose.

The right company can quickly and effectively get you through this process.

Request credit limit increases

Depending on your exact situation, this idea may not be possible, but it does not hurt to try.

Request credit limit increases on your revolving accounts, such as credit cards. Request it, but don’t use it!

What will this do for you?

Request and receive credit limit increases. With approval, the percentage of your loan balance against your credit limit will go down. Since this is one factor that impacts your credit score, it could help increase your score. This assumes you receive approval.

Remember, request the increases, but don’t actually use them!

Don’t close old accounts

If you have old credit accounts that you are no longer using, keep them open. But, again, don’t use them!

Keeping them open but unused will give you longer credit history. This positively influences your credit score.

Avoid applying for new credit

New applications for credit will tend to decrease your credit score. Avoid applying for new credit.

Give it time

You will want to give plenty of time to take these actions.

It is always a great idea to start early, many months in advance before you actually want to buy your next home.

Sometimes time is the only solution. Strategies often work better when you can give them enough time to work.

Consider waiting to get mortgage financing

This goes right along with the previous statement.

It might not be the right time for you to pursue mortgage financing. This can be true either to buy your next home or to refinance your current mortgage.

You could be much better off taking the time you need.

Follow the ideas above, do a good job on them over enough time. Don’t push the idea that you have to do the mortgage now.

It is much better to do a good job getting your situation in great shape than to try to force a bad deal now.

As always, your authentic Real Mortgage Consultant from Winner’s Mortgage will be right there to help you. With a proven track record, together, you can do whatever is possible so that you can WIN with your mortgage.