How to Know That You Are Getting the Right Mortgage for You

How to choose your mortgage and your mortgage originator is the most common myth and lie about mortgages today.

Yes, the interest rate is one of the biggest lies that the culture tells people, and people don’t know any better so they believe it.

This is the lie: “All that matters is the interest rate and fees.”

It is the most common lie with mortgages

People think all that matters is the interest rates and fees and they don’t think about anything else

People think it

Mortgage companies advertise it

And it is so wrong . . .

Most people focus on the rate and don’t think about anything else

A mortgage is a big financial operation . . .

It’s the largest loan you will probably ever have

It is the highest interest cost

Obviously, you would not want to only consider the lowest bidder without thinking of anything else, wouldn’t you agree?

Think about it . . .

Let’s hope this never happens to you . . .

But let’s say you are diagnosed with cancer, or you need heart surgery . . .

How are you going to choose your physician and your medical team?

Would you choose a physician based on price? Or quality?

You wouldn’t choose the physician with the lowest fee who barely graduated from medical school for your cancer treatment or your heart operation, right?

And if the physician quoted a price or gave you a treatment plan without running any tests, you couldn’t know you are getting good advice, could you?

You wouldn’t really want to trust your life to someone who treated you in such a sloppy way, would you?

So, obviously, you wouldn’t want to trust your financial life to the lowest interest rate bidder who doesn’t think to ask you any questions or get to know your situation

This makes sense, right?

But that’s what happens all the time with mortgages . . .

Uninformed people who let themselves fall prey to anchoring focus only on the interest rate . . .

Sentencing themselves to many, many years of expensive mortgage payments, along with all of their other payments,

Never giving themselves a legitimate chance of becoming financially independent . . .

Never having given themselves an opportunity to be part of the 5% of people who succeed financially, instead, they remain part of the 95% who fail

So sad . . .

Here’s the truth . . .

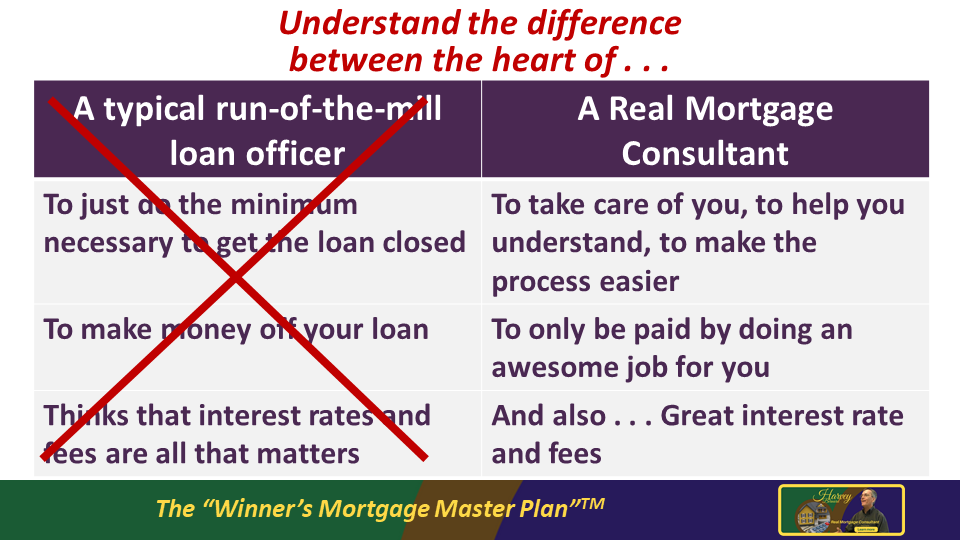

There are two types of mortgage people you could choose . . .

You need to understand the difference so you don’t make the wrong choice . . .

You need to know the difference between a typical run-of-the-mill loan officer – that will be most of them out there

And an authentic Real Mortgage Consultant

The heart of a typical run-of-the-mill loan officer is to just get it done and make as much money as possible

On the other hand, a genuine Real Mortgage Consultant wants you to WIN . . .

This is why I am a Real Mortgage Consultant. My cold, hard experience made me determined to help others.

I want to save you from losing with a lifetime of loan payments, and WIN instead, potentially being free of all loan payments, including the mortgage, in as little as 6-10 years.

So, what do you look for when you are seeking a dependable Real Mortgage Consultant?

So, what do you look for when you are seeking a Real Mortgage Consultant?

Here are some questions to help you investigate . . .

Here’s the first question to consider . . .

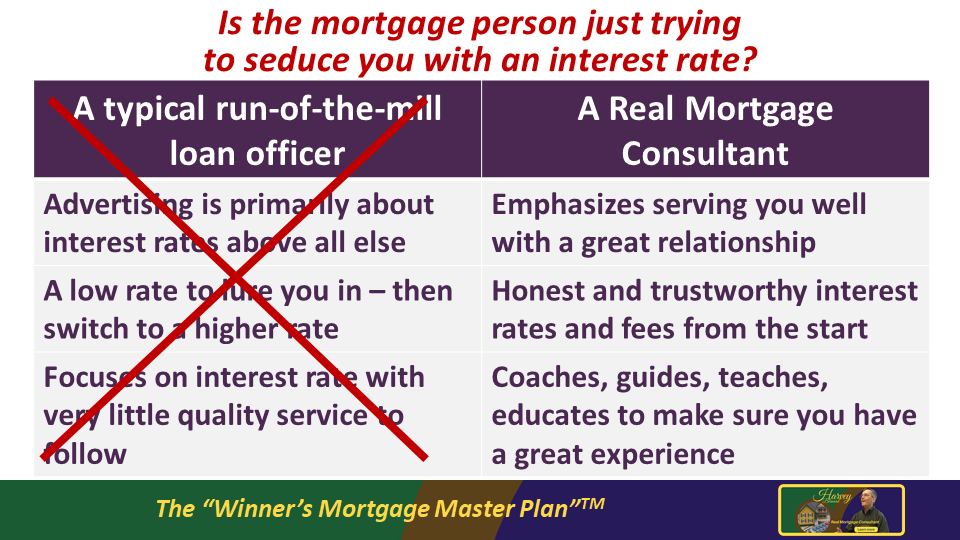

Is the mortgage person just trying to seduce you with an interest rate?

A typical run-of-the-mill loan officer focuses on the rate, not what really matters.

Beware, that loan officer likely has little else to offer you.

On the other hand, a leading Real Mortgage Consultant will emphasize

… Building a great relationship with you

… An honest and trustworthy relationship

… And doing everything possible to make sure you know what is happening and understand the process

… And you’ll still get a good rate and fees

Another question . . .

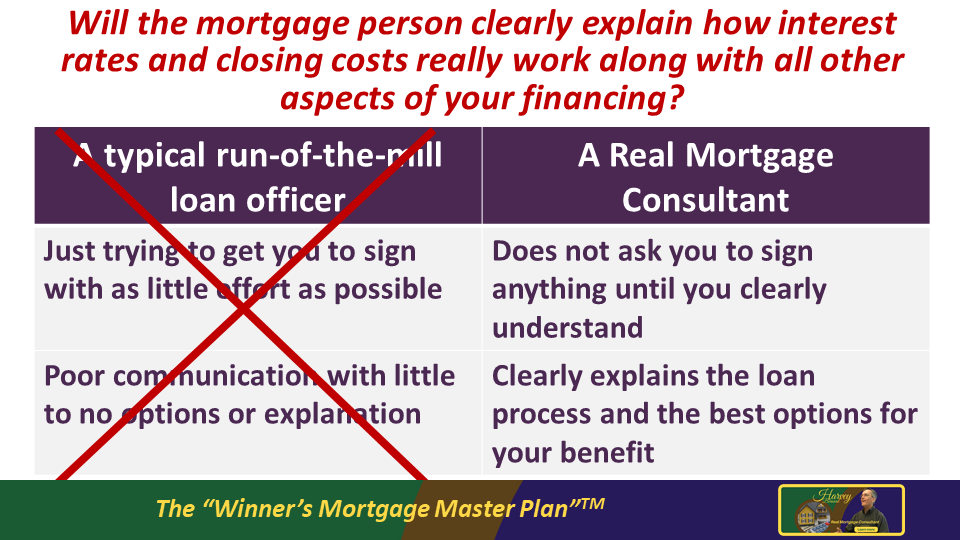

Will the mortgage person clearly explain how interest rates and closing costs really work along with all other aspects of your financing?

Sadly, a typical run-of-the-mill loan officer just wants to get it done as quickly as possible to get the paycheck

Any additional education, explanation, or communication is just too much work

On the other hand, an experienced Real Mortgage Consultant . . .

Lives to make sure you understand because that’s what it is all about

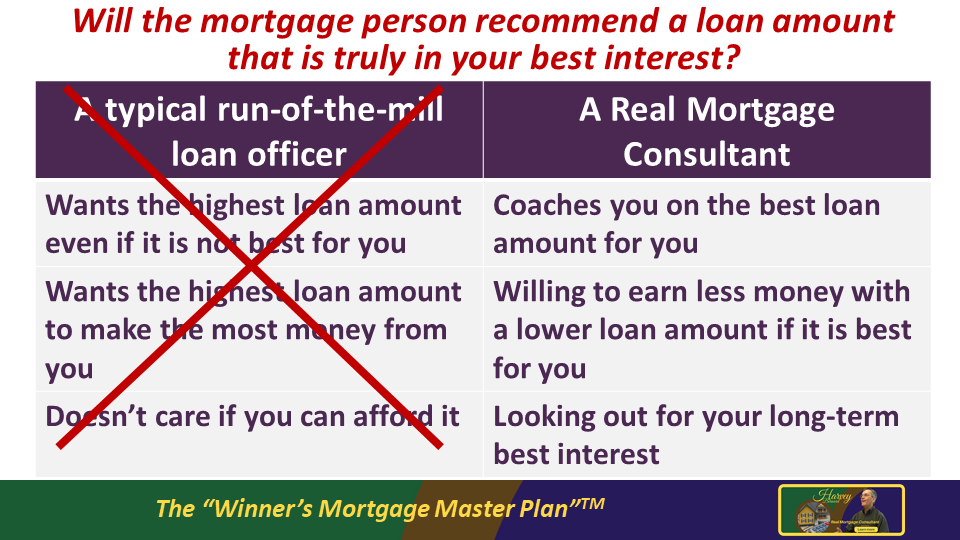

Will the mortgage originator recommend a loan amount that is truly in your best interest?

A typical run-of-the-mill loan officer will go for the largest loan amount you can be approved for because that is how they make the most money

… You’ll be in big trouble

… You may have trouble making the payments

… You’ll likely end up part of the 95% who lose

And the typical run-of-the-mill loan officer won’t care about you, just that they made the most money possible

On the other hand, an authentic Real Mortgage Consultant will recommend a loan amount that is good for you

… Probably less than the full amount for which you can be approved

… And it will be an amount that will help you WIN

… A smaller commission is okay because it’s really about you WINNING

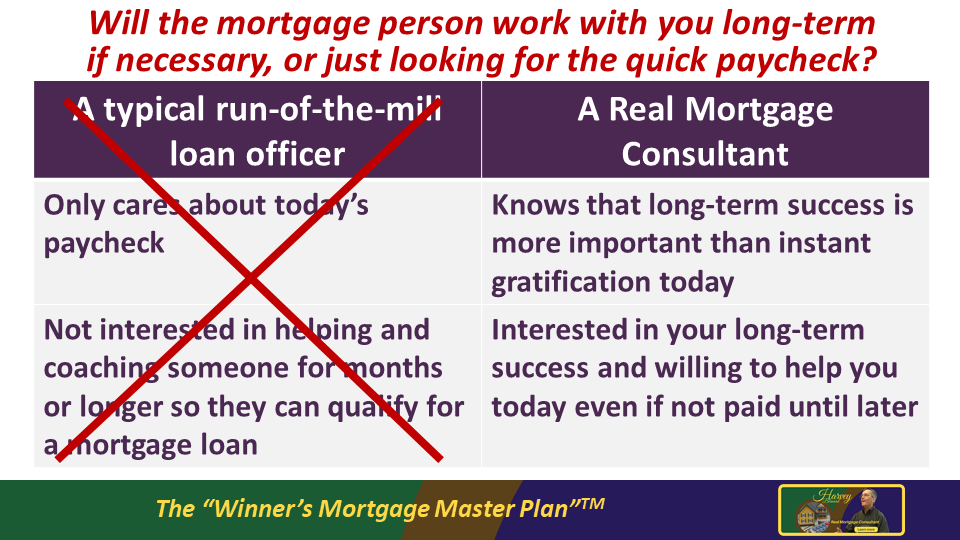

Will the mortgage originator work with you long-term if necessary, or is that person just looking for a quick paycheck?

The typical run-of-the-mill loan officer is just looking for the quick paycheck, not for anything that does not pay off quickly

On the other hand, an acclaimed Real Mortgage Consultant works for the long-term benefit of you

And knows by looking out for your long-term benefit, the Real Mortgage Consultant will benefit as well, maybe not right away, but in the long-term for sure

Why is this true?

This is a great time to emphasize this point . . .

A field-proven Real Mortgage Consultant believes and lives the Zig Ziglar quote

“You can have everything in life you want if you’ll just help enough other people get what they want.” -Zig Ziglar

For an accomplished Real Mortgage Consultant, it’s all about your best long-term benefit, and then the dependable Real Mortgage Consultant knows the benefit will come.

Here’s another question to check . . .

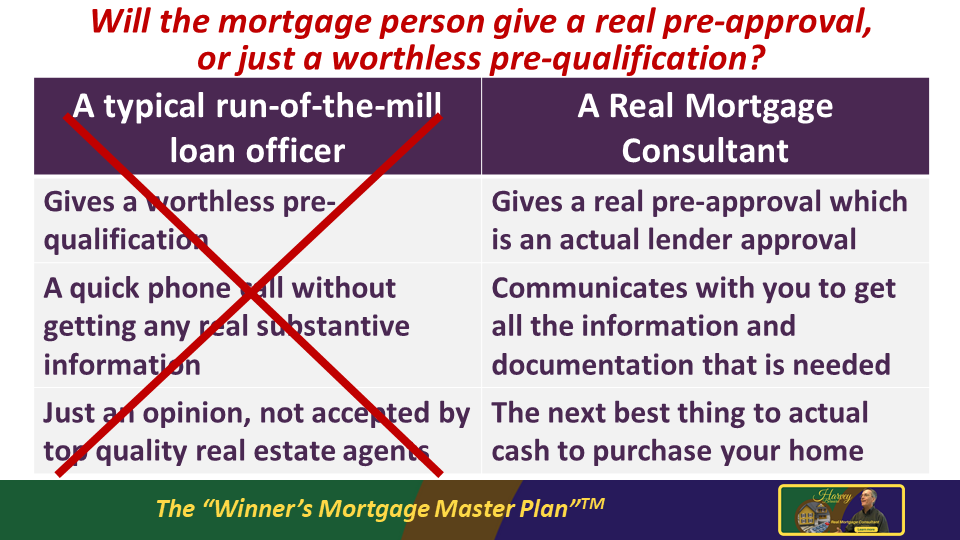

Will the mortgage person give a real pre-approval or just a worthless pre-qualification?

There is a huge difference between the two, and it always amazes me how a typical run-of-the-mill loan officer thinks that they can just get away with only a pre-qualification, rather than a pre-approval

A pre-qualification is the lazy way and it’s just an uninformed opinion based on a phone call, but nothing of substance

A genuine Real Mortgage Consultant will give a real pre-approval

It’s getting your documents, a real mortgage application, with a real underwriting pre-approval

It’s the real thing, and it’s what you must have

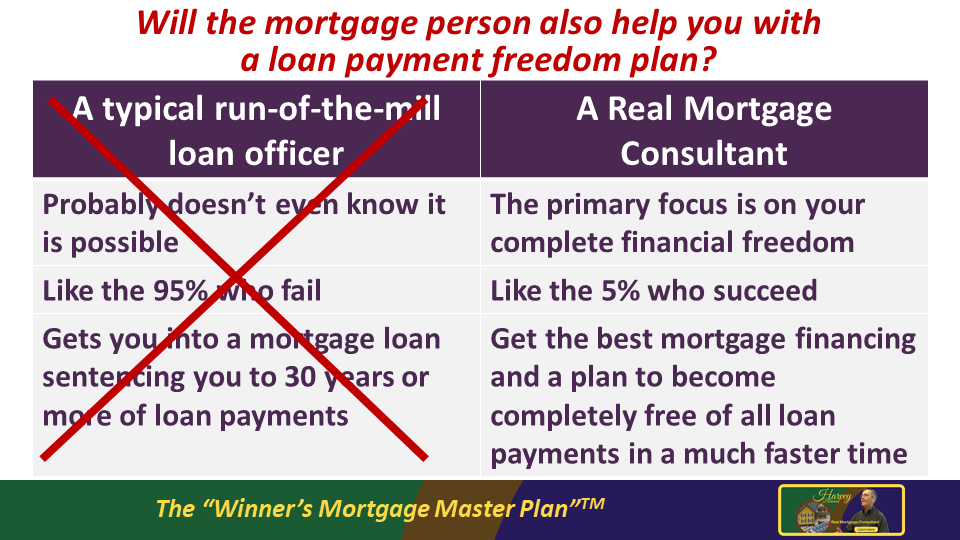

This could be the most important question of all . . .

Will the mortgage originator also help you with a loan payment freedom plan?

A typical run-of-the-mill loan officer probably won’t even know what this is

A typical run-of-the-mill loan officer will sentence you …

… to a lifetime of working to make loan payments,

… making other people rich instead of you,

… never being free of loan payments,

… being part of the 95% who lose

On the other hand, when you work with a leading Real Mortgage Consultant, the Real Mortgage Consultant will help you with a plan tailored to your needs so …

… You can be part of the 5% of people who succeed financially

… You can work for yourself, and make yourself wealthy

… You have the freedom to work if you want or do what you want

As I have studied what it takes to be financially free, from all the statistics out there, I’ve concluded that around 5% of people are financially successful, they WIN. And 95% fail, they lose.

Every day you make a choice – will you be part of the 95% of people who lose financially, or will you become part of the 5% of people who WIN?

It is the difference between long term thinking – or short term thinking.

It is a clear choice.

You could choose the typical run-of-the-mill loan officer who only quotes interest rates and fees, collects the commission check, and is gone after the loan closes.

Short term thinking. Bad choice.

Or you could choose a recognized Real Mortgage Consultant who has about the same interest rate and fees, looks out for your well being, coaches you through the mortgage process, considers how this new mortgage affects you overall – and is still available to you after the loan closes.

Long term thinking. Great choice.

A professional Real Mortgage Consultant will help you get there with the top-of-the-line “Winner’s Mortgage Master Plan”

What are your best loan options?

A professional Real Mortgage Consultant will get to know you well enough to help you make the right mortgage choices.

Should you pay closing costs?

It can be possible to not pay closing costs at all. It may or may not be in your best interest depending on the situation. Your straightforward Real Mortgage Consultant will help you decide.

A typical run-of-the-mill loan officer probably won’t even consider it.

Sometimes it is in your long-term best interest, most of the time it isn’t to pay discount points.

Again, a typical run-of-the-mill loan officer probably won’t even think about it. Your recognized Real Mortgage Consultant will check it for you.

How about the type of mortgage loan that is best for you?

Do you know when it makes more sense to get an adjustable-rate mortgage rather than a fixed rate?

Or how many years for the loan makes the most sense for you?

There are definite factors that your leading Real Mortgage Consultant will consider, and a typical run-of-the-mill loan officer won’t think about.

Will you receive coaching through the loan process?

Going through the process of getting a mortgage loan is a mystery to so many people.

There are so many steps. So many things to do. So many documents needed. So many questions.

Your genuine Real Mortgage Consultant will coach you on what to expect, giving you cold, hard facts. On how the process works. Guide you each step of the way. Always working to help you in the best way possible.

It doesn’t have to be a nightmare like it could be with a typical run-of-the-mill loan officer who only quotes interest rates and fees and only cares about getting through it to get the commission in the short term.

Your fully-trained Real Mortgage Consultant will coach you each step of the way. Communicate with you. Inform you. Help you understand so you win long term.

What happens after your loan closes?

This is where the typical run-of-the-mill loan officer is gone. Short term. Commission check in hand. On to the next victim to do it all over again. Leaving you to sink or swim.

On the other hand, your relationship with your dependable Real Mortgage Consultant continues long term . . .

You feel smarter because your credible Real Mortgage Consultant took the time to coach you, teach you and make it easier for you.

And it’s still not over. Your authentic Real Mortgage Consultant is still with you.

Coaching you when you need it on how to work your plan your experienced Real Mortgage Consultant helped you set up. The plan that you said you wanted to do. To get you to the long term goals you said you wanted when you first met your accomplished Real Mortgage Consultant. To be part of the 5% who WIN.

Choose to work with your acclaimed Real Mortgage Consultant.

So you win. And you are on your way to freedom.

Let your field-proven Real Mortgage Consultant guide you to getting the right mortgage from the very beginning, through the process, and to keep you from getting ripped off.

WINNING used to be hard …

WINNING doesn’t have to be hard anymore

This is where your dependable Real Mortgage Consultant helps you WIN with the gold standard in “Winner’s Mortgage Master Plan”

When you work with your top-drawer Real Mortgage Consultant, instead of just some typical run-of-the-mill loan officer, you will know exactly how to WIN your freedom!

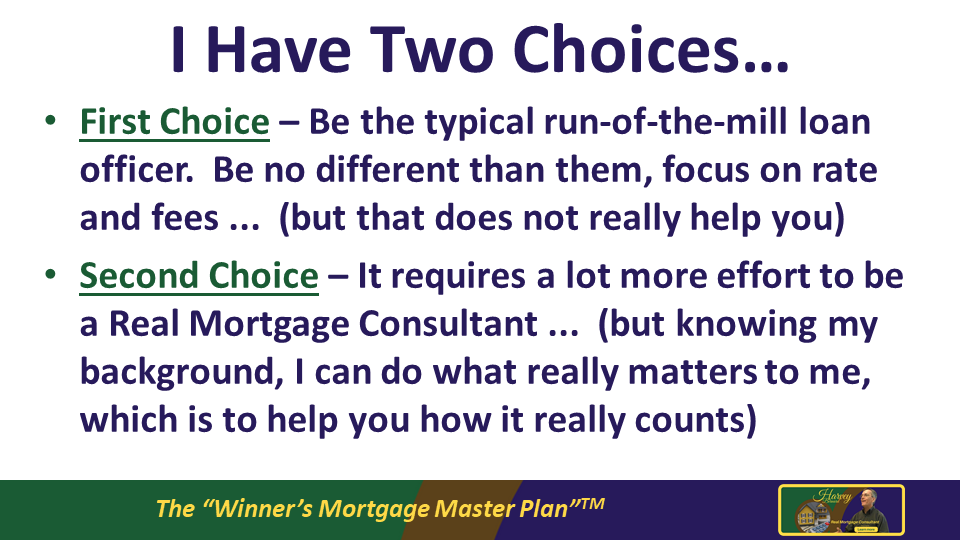

I have two choices in my mortgage work …

My first choice is that I could be the typical run-of-the-mill loan officer that you see so many of out there . . .

There are so many typical run-of-the-mill loan officers that you are in great danger of accidentally choosing one if you don’t know what you are looking for.

I could have chosen to be no different than them, just quoting interest rates and fees, trying to get the loan done as quickly as possible so I got paid, and not really caring about you at all.

I could have made that choice like so many typical run-of-the-mill mortgage loan officers have already done.

Or I could choose to be an experienced Real Mortgage Consultant.

While I know that interest rates and fees have some impact, they are far from the most important part of a mortgage.

So instead, with my background of cold, hard experience with debt and mortgages, I could never do this work as the typical run-of-the-mill loan officer does it.

The only choice that works for me is to be your fully-trained Real Mortgage Consultant where I give you so much value, and so much extra effort, that you are truly in the position to WIN with your mortgage and to make yourself free of loan payments, free of your job, and free to do what you want.

That is the only way it can work for me, and of course, that is how it benefits you the most.

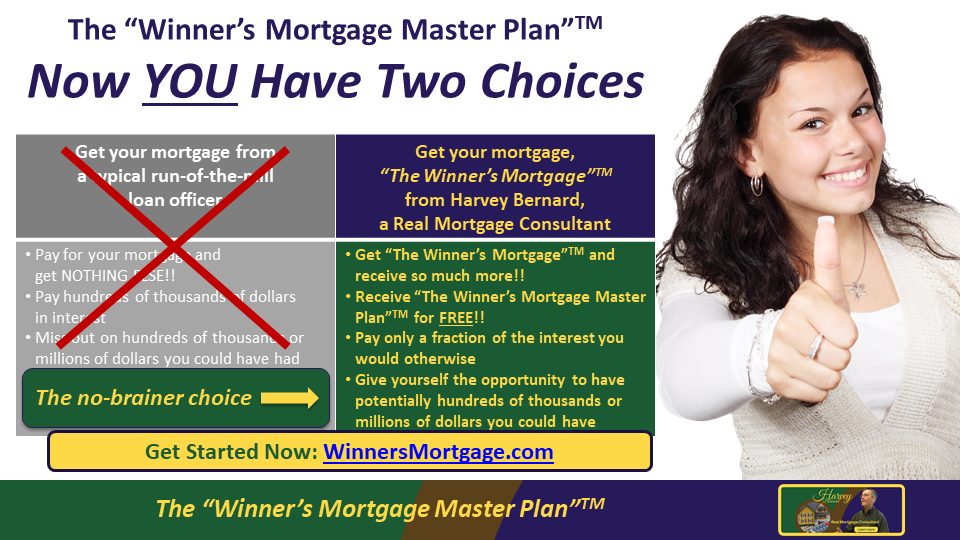

Now you have two choices …

This is where you see a very distinct difference between a typical run-of-the-mill loan officer and a genuine Real Mortgage Consultant.

On the gray left column, with a typical run-of-the-mill loan officer, you will pay for your mortgage, and you will get nothing else for it!

Plus you will be destined to pay hundreds of thousands of dollars to the lender that you have to earn at your job, rather than getting to keep it for yourself!

And you will miss out on hundreds of thousands or millions of dollars that you could have had, and now they will get it instead!

It’s clear, you get so little and lose so much with a typical run-of-the-mill loan officer.

But with your acclaimed Real Mortgage Consultant in the blue and green right column, you get so much more …

You get the top-of-the-line “Winner’s Mortgage Master Plan” for FREE!

You pay only a fraction of the interest you would pay otherwise.

And you give yourself the potential to have hundreds of thousands or millions of dollars you could have, instead of giving that opportunity to the lender

Now YOU have two choices …

And it’s a no brainer choice …

The bad choice is to choose a typical run-of-the-mill loan officer, then you get nothing extra, you are destined to pay so much more money to the lender that you have to earn, and make the lender wealthy instead of yourself

The right choice is that you can make the no-brainer choice and choose your experienced Real Mortgage Consultant, then you get so much more, and you have the very real opportunity to save so much money in interest and keep more of the money you have to earn for yourself instead of giving it away to the lender to make the lender wealthy instead of you

Get started now, click the “Get Started!” button to start our Client Questionnaire. Get started on our exclusive Winner’s Mortgage process for you.

This is what it’s all about . . .

The mortgage is probably the biggest financial operation of your life

Choose the mortgage person you work with as carefully as you would choose your physician and medical team for a major medical condition

It has the same impact on your financial health as it does your physical health

You simply can’t afford to make this life-changing choice any more based on price.

Start now at the button below. Take action and get started today!