First-time homebuyers who want to own their own home.

Buying your first home can be an exciting, but challenging, experience.

Owning your own home is a big deal.

And think about what you are doing. This will likely be the biggest purchase of your life so far – and it will also be the largest loan of your life.

Here’s the sad fact. This can be such an intimidating process. Most first-time homebuyers don’t know where to start and they make so many mistakes.

This does not have to be true for you. You can successfully buy your first home. You can do it the right way, and you can WIN with your first home and your first mortgage loan.

Here’s what you need to know.

What is a first-time homebuyer?

If you’ve never purchased your own home before, you qualify!

More situations qualify as a first-time homebuyer. This is according to the U.S. Department of Housing and Urban Development (HUD).

You also qualify as a first-time home buyer if …

… You or your spouse have not owned your own home in the past three years …

… You only owned a home with a former spouse while you were married …

… The only home you have owned was not considered real estate. An example is such as a manufactured home sitting on land you did not own …

… In rare situations, you owned a home – it needed substantial repairs to meet building codes.

This is for first-time homebuyers. But even if you are not one, most of this information still applies to you, so let’s continue!

What do you need to do before you even get started buying your own home?

It’s very smart and a great idea for you to consider these important factors before you actually proceed.

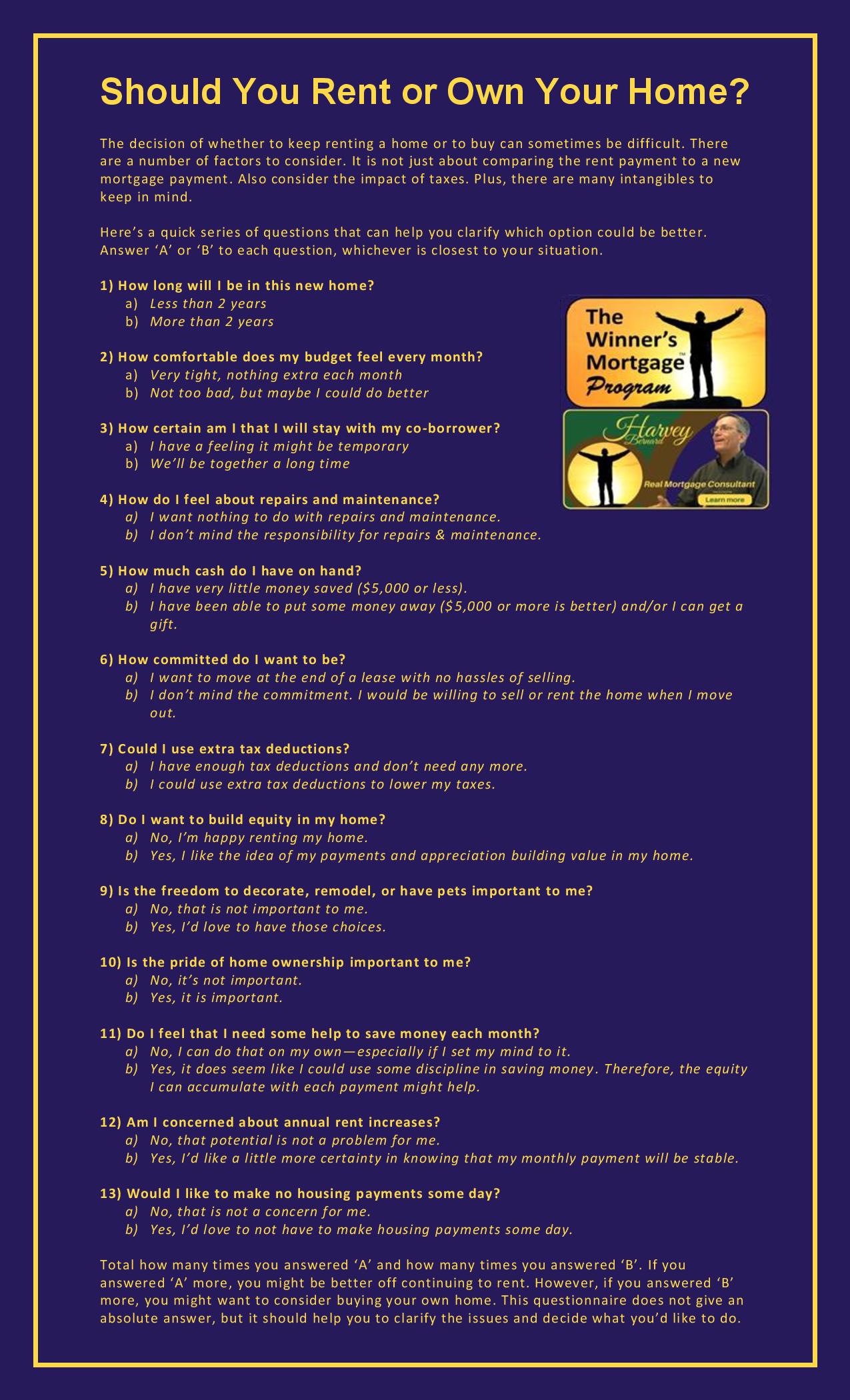

Is renting or buying your home better for you?

Why do you want to own your own home?

This is an important question to ask yourself. You will want your emotion and logic to agree that now is the right time.

Some people are better off renting.

The critic’s choice Winner’s Mortgage’s first priority is that you only buy if it is right for you. This is true even though Winner’s Mortgage earns an income for your purchase.

We would never want you to proceed with purchasing your home if it isn’t right for you. You shouldn’t want to either.

So please think about it.

You will want to consider both the financial and personal costs of buying.

See the questions below. They will cover the financial considerations of buying your own home.

Let’s think about the personal costs for a moment.

Are you thinking to buy based more on emotion than logic?

Buying your home is a major life milestone. It can be so easy to get too attached to a certain house. It’s so easy to imagine a perfect lifestyle. So easy without considering the real lifestyle changes.

For example, how do you feel about maintenance, upkeep, and repairs? You might have to do this yourself. Or hire someone to do it in your own home.

In a rental, a landlord would take care of it for you.

If you’re good with it, awesome! Be sure that it will also fit well into your lifestyle and budget.

Or will you need to make other sacrifices to own a home that you don’t need to make when you rent?

For example, what if you’re a couple and one of you currently does not have to work at a job? Will the cost of owning a home require both of you to work outside the home? Would you be okay with that? You don’t want that to come as a surprise.

Are you willing to invest your “sweat equity” into a home to make your own improvements?

If you are, it can make more sense for you to buy. This gives you then have very real potential. You could actually do the work yourself. This can help increase its value.

If you don’t feel comfortable doing work yourself, can you afford to hire it done?

If either of those is true, that can be a good indicator that buying could be right for you.

If not, buying may still make sense for the right house.

Don’t take any of this as discouragement from buying your own home.

Think of it as an encouragement to logically consider all factors before proceeding emotionally.

Then, if it all lines up well, awesome! Keep going and check the rest!

How is your current financial situation?

You don’t want to go into buying your next home in a weak financial condition.

Owning your own home will put stresses on your finances that are difficult to expect. They will usually be more than you think they will be, and they often come at the worst possible time.

Be sure you are in a strong financial condition. Here are more questions to consider.

How much money do you have saved?

More is better and enough for a 20% or more down payment would be great.

But it can make sense to buy with less than 20% down. Get the straight information from your Real Mortgage Consultant at Winner’s Mortgage and get the cold, hard facts. Discover whether you have enough saved to make sense going ahead now.

Practice living financially in your new home

If you don’t have enough money saved yet (or even if you do), here’s an idea that can let you WIN in many ways.

Practice living on your level of new expenses while you are still in your current home.

So, what does this mean?

Determine what your new payments will need to be in your new home. Then subtract what your costs are in your current home. Make a payment of the difference each month to your savings.

This will do two important things for you:

First, you will be able to practice living each month with your new higher level of outgoing payments. That allows you to prove to yourself that you can do it.

Second, this will build your savings account. It puts you in a stronger position financially when you actually do buy your next home.

Or, if you still have debts, especially credit cards, use this extra money every month to pay them off.

Keep this up as long as it takes to build your savings to the necessary amount. It will prove to yourself that you can sustain the new higher payments in your new home.

That will be an awesome way to give you the confidence you need to buy your home!

Do you have anyone who can give you a gift toward your down payment?

If yes, that can be a great help to you.

The giver needs to be a family member or a close friend with a relationship you can document. Certain government first-time homeowner programs can also give a gift.

There are two main ways to give gift funds.

The giver can provide the funds at least 3 months ago. If so most likely no documentation will be necessary.

Be sure to deposit the funds in your bank account at that time. When the funds do not show as a deposit on your bank statement, the lender will not ask about it. Lenders normally request your most recent one or two months of bank statements.

Here’s the other way when you receive the funds more recently. In that case, you must prove a friend or family relationship with the giver. This requires a gift letter in a standard format.

Bank statement from the giver and from you are also needed. They prove that the funds came from the giver’s bank account and into your bank account.

The giver cannot require that you pay this money back, it must be a true gift.

Contact your fully-trained Real Mortgage Consultant at Winner’s Mortgage. You will be able to receive more information on your specific situation. It is better to inquire early so there is the most amount of time to plan your best option.

How much cash will you have leftover for unexpected expenses for your new home?

Calculate the cash you need for a down payment and closing expenses. Be sure you know how much you will have leftover after closing.

Keep a reserve fund for emergencies and unexpected expenses that may come up. Especially cover expenses related to becoming a homeowner. These are expenses that you would not have had as a renter.

A savings fund covering six months of your monthly expenses is a great goal to shoot for.

It is a good idea to reduce your down payment somewhat to keep more ready cash available. But know the trade-offs of different down payment amounts. Compare how reducing the down payment increases your loan costs.

The various trade-offs are too many to detail here. Your experienced Real Mortgage Consultant will be very helpful. You can receive help in designing your strategy. You can get the best of both areas. You can have better loan terms. Balance this with keeping more money for unexpected expenses.

How much debt do you have now?

How much do you owe and what are your monthly loan payment obligations? Would it make more sense to pay down or pay off these debts before adding a new financial need?

What will it look like to drop your current rent payment? Instead, substitute a new mortgage payment and other homeowner expenses?

Think carefully. Don’t let your new home become a financial burden. Instead, let it the blessing in your life that you want.

Paying down your debt is a great idea before you buy your home. You receive our exclusive Loan Payment Freedom Secrets Master Class. It is an awesome help for you on how to reduce your debts.

(This is one of the modules in our Winner’s Mortgage Master Plan. It is free for you when you do your mortgage with Winner’s Mortgage.)

How is your credit history?

The better your credit history, the better loan terms you will receive. Better loan terms will save you money.

If you have some issues that you need to clean up, start early before you try to buy. It can take time as you work to improve your credit.

But don’t do this alone. You need the seasoned advice of your Real Mortgage Consultant. Some items on your credit report may be hurting your credit, others may not have an impact. You need to know where to put your effort.

You can see a free first look at your credit report at AnnualCreditReport.com. This is the only site you should use. It is the only site authorized by the Federal government for you to see the listings on your report.

You will not receive credit scores with this report. For that, consult with your credible Real Mortgage Consultant at Winner’s Mortgage. We will discuss your home purchase goal with you. We will get your credit report – the same report mortgage lenders use. Then we will advise and assist you in how you can best move forward to improve your credit as much as possible.

Even if it takes some time for you to be ready to buy, we’ll work with you along the way. Don’t pass up the opportunity for a coach guiding you in your desire to own your own home.

This process is well worth it. It can save you hundreds to thousands of dollars – all money that you work hard for. Don’t let it go to waste.

Do you know where your money goes each month?

This is so important that you know where and how much you spend money. This is often called a budget.

A lender won’t check this, they will assume that you spend an average amount. The lender will stop at comparing your total loan payments to your gross income (before taxes). While that may work for the lender, you need to take it a step further.

Are you spending more than you should? Do you have room for the potentially higher costs of homeownership? Will you have room in your monthly budget? Can you actually pay down and eventually pay off your debts? Including your mortgage?

Here’s the exciting part. When you do this, you have very real potential. You can be completely free of all loan payments, free of your job, and free to do what you want. And that’s true freedom!

Here’s what you receive when you close your mortgage with Winner’s Mortgage. You get free membership in our exclusive top-drawer Winner’s Mortgage Master Plan. It is valued at thousands of dollars.

Our Loan Payment Freedom Secrets Master Class is part of our hard-hitting Winner’s Mortgage Master Plan. You learn how you can become completely free of all loan payments. This includes your mortgage payment, in as little as 6-10 years on your current income.

Keep your monthly spending in control each month. This is important. You can enjoy the blessing of your new home, and you can ultimately have the blessings of freedom in your life.

This is essential before you start to buy. Know your spending and control it.

Consult with us at Winner’s Mortgage. Don’t settle for less. We’ll do all we can to help you figure it out.

Get the official answer on what you can afford

Your next step is to determine what price home you can buy.

Get pre-approved with your field-proven Real Mortgage Consultant.

Here’s the essential next step. You must get pre-approved for your financing with your acclaimed Real Mortgage Consultant.

Get pre-approved before finding a real estate agent …

Get pre-approved before you start looking at houses …

Especially before you fall in love with a house that you may not be able to pay for …

Get pre-approved, not just pre-qualified …

And what is the difference between pre-approved and pre-qualified?

Pre-qualified. A typical run-of-the-mill loan officer just does a quick conversation with you. You answer some basic questions about your financial situation. Then that loan officer tells you that you can buy a house only based on that.

Nothing checked or verified. No documents requested. Nothing was done at all except a quick conversation.

If you trust that, you are in big trouble, and you are not likely to get a house.

Your Real Mortgage Consultant will do a real pre-approval for you. Don’t settle for less!

Pre-approved. This means that you actually fill out a loan application. You give documents to your dependable Real Mortgage Consultant. These documents include your pay statements, bank statements, and other documents. They prove what you entered on the loan application.

Your fully-trained Real Mortgage Consultant provides this information to the lender. The lender pre-approves you based on your financial situation to buy a home up to a certain price. What’s left is to add the property you find, then confirm the property fits the approval.

If you don’t already have a real estate agent, your genuine Real Mortgage Consultant will recommend an agent for you. Follow this recommendation if you can. It streamlines the process for you.

You will receive a pre-approval letter. Give this to your agent and to the seller of the house you choose.

To WIN with your home purchase be sure to get a real pre-approval from your Real Mortgage Consultant. You will lose with anything less, such as just a meaningless pre-qualification. You expect the best. We demand it!

Understand what you can actually afford compared to your pre-approved amount

Your pre-approval for your home purchase at a certain price will be higher than would be good for you.

Here’s what happens.

The lender approves you up to a maximum debt-to-income ratio. This is appropriate for their specific loan program.

That approval is based on your income before taxes.

But what you actually have to live on is your after-tax take-home pay. The lender does not consider how much money you actually spend. This includes food, transportation, entertainment, and your other expenses.

You can become completely free of all loan payments, free of your job, and free to do what you want. This means you must buy a home at a lower price than the maximum for which the lender approves.

This provides the flexibility to follow our exclusive gold-standard Loan Payment Freedom Secrets plan. You can pay off your loans fast. But if you try to buy a home at the maximum approval amount, you have a problem. You will not have the flexibility you need to get freedom for yourself.

So, consider what price you actually can afford to buy. It will very likely not be the largest amount the lender approves.

Your experienced Real Mortgage Consultant will help you with this calculation. This is true even if it means a slight reduction in the commission for the loan.

Your genuine Real Mortgage Consultant’s first motivation is to do what is right for you – even though there is no benefit.

Confirm the payment for your recommended purchase price actually fits your budget

Once you’ve come to this point, you have a good idea of your finances. You have a good idea of what you can afford.

So, connect the dots at this point …

Go back and review what you’ve done so far and confirm that your recommended payment works for you.

Your Real Mortgage Consultant will be ready to help you if you like. You get all the facts and can depend onthe expert.

Now you’re ready to shop for your next home!

You’ve done a great job up to this point as you’ve followed along.

You have asked yourself the right questions and given yourself honest answers. You have done everything possible to look at your home buying process. You’ve done it logically and realistically to back up your emotional desire to own your home.

You have considered your financial situation. You have determined that you feel comfortable financially to buy.

You received a real pre-approval letter from your fully-trained Real Mortgage Consultant. You worked together to decide how much you actually want to spend. Ideally, this is something less than the maximum pre-approval amount.

You accepted the recommendation of a great real estate agent from your professional Real Mortgage Consultant. Or you already had an awesome agent you already know to help you.

Now, it’s on to the rest of the loan process.

To see how the rest of your home-buying process goes, follow this link here. You’ll love our exclusive Winner’s Mortgage program loan process!