People who want to buy an investment property.

Investment and rental real estate have the potential to make money, could be a lot of money.

Many of the world’s wealthiest people became rich through real estate. They all started somewhere, most likely with one property.

If this interests you, acquire an investment property at the right price. Then finance and manage it correctly. It can provide a cash flow stream for you almost immediately. But do it wrong, and it could become a bottomless pit for you to throw away money, never to see it again.

The key is to do it right.

Start with your field-proven Real Mortgage Consultant and Winner’s Mortgage. Real estate investing could be one way to freedom for you. You could become free of all loan payments, free of your job, and free to do what you want.

Does it sound interesting? Do you believe you have an aptitude for it? Do you have what it takes to be successful in real estate investing and management? Then explore further here.

Is real estate investing right for you?

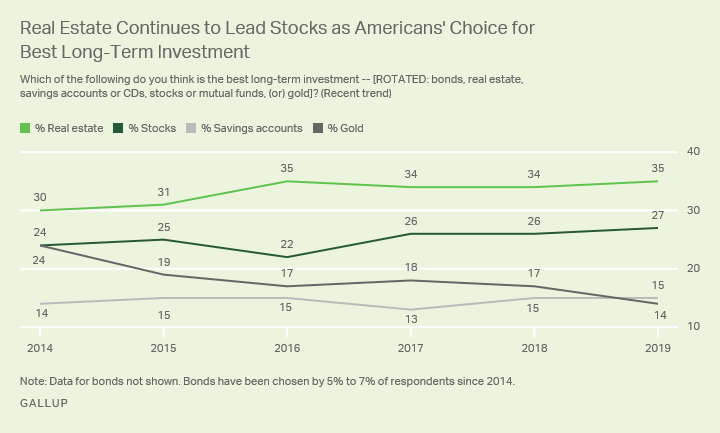

In a Gallup study, 35% of Americans agree. They believe that real estate is the best long-term investment option. So it’s worth considering.

Before you invest in real estate, you need to be sure that it is right for you.

What should you consider?

What is your comfort level with being a landlord?

Are you comfortable doing the management yourself? You will probably need to do it yourself … at least with the first few properties.

Do you feel comfortable advertising for tenants? How about showing the property? What about rent collection, especially if they don’t pay? Can you deal with any payment problems that may come up?

How do you feel about the minor maintenance tasks that will be required? Do you have handyman abilities? The more you can do yourself in the beginning, the better chance you have of being profitable.

Consider the timing. Some problems with properties can’t wait. They may occur at the worst possible times, while you’re at your job, the middle of the night when you’re out of town. Have a backup plan and be sure you can afford the backup plan if it’s needed.

Eventually, you could have more options. It requires acquiring additional profitable, cash-flowing properties. It will be awesome to hire the maintenance done for you, but it won’t start off that way. And you do need to know how to do it yourself even if you hire it because you need to supervise the work.

With more properties, it can be more affordable to hire a property manager. A good manager can oversee it all for you, but it won’t be practical to start off that way.

Do you feel comfortable or competent with maintenance or management? If not, it’s better to look elsewhere besides real estate.

But if you do feel comfortable and competent, it’s a great way to start earning an additional income.

Are you financially ready to take on an investment property?

Do you have other debts, such as car loans, student loans, carrying balances on credit cards, etc.?

Or do you have some major expenses coming up soon that will consume additional cash? Will you have children attending college? Do you need to pay for a wedding? Or are there other needs?

If yes, focus on paying off other loans first. Or focus your available cash on other large expenses. The last thing you need is another place cash needs to go while you are paying other loans and expenses… That is asking for trouble. Most likely, trouble would find you and you will end up deeper in debt.

Our exclusive Loan Payment Freedom Secrets Master Class is perfect. Follow it and it can help you pay off those other debts first. It is a standalone program. It is also part of our exclusive top-of-the-line Winner’s Mortgage Master Plan, valued at thousands of dollars. It is a free gift to you when you do your mortgage with Winner’s Mortgage.

Contact your Real Mortgage Consultant at Winner’s Mortgage. Find out for more information on how you can get access to these exclusive programs. Get the plain honest truth.

Have you accumulated a down payment for an investment property? Do you have a cash reserve specifically designated for investment real estate?

It takes a larger down payment to buy an investment property. It is as much as 20% to 30% of the purchase price, plus costs to close.

There are programs available for a smaller down payment on an investment property. But your loan terms will be more expensive. This means that the cash flow for the property will likely not work to your advantage. This can cause you too much trouble and it will work against you rather than for you.

Besides the cash for the down payment, you need an extra cash reserve, six months or more. This cash reserve is essential. It covers maintenance and repair costs. It is there for vacancies when you are not receiving income from the property.

Keep this in mind. This cash reserve for an investment property must be an extra cash reserve fund. It is not the same one you already have for your personal expenses.

How is your credit?

Lending standards are more strict for investment properties. You will want your credit to be good, excellent is even better.

Financing for investment properties can be available for lower credit scores. The terms will be less advantageous to you. Worse terms mean that you may very likely have trouble making money on the property.

It’s best not to try to get by on a lower credit score. It’s better that you do what you can to get yourself well positioned on your credit before proceeding.

How does it look? Are you well-positioned to own investment property?

Looking back on the various factors in this section, what do you think? Can you check off each of these items that you are ready to own investment property?

If you can’t say yes to each one, then consider it is better that you do not proceed now with investment property.

Can you say that you have the aptitude and skills to own investment property? Are you well-positioned financially? Awesome, then move on below!

What you need to know about financing residential investment properties.

Mortgage financing standards for residential investment properties are more stringent than owner-occupied properties.

Types of mortgages for residential investment properties

Government-backed loans, FHA & VA. You can buy a residential investment property with a lower down payment for FHA and VA. The catch is that you must live there. This means you are looking for a duplex, triplex, or fourplex and you will live in one of the units. This is an awesome first investment property to own and a great way to get started. Depending on the property and the numbers, it could pay for your home. Plus it can provide more cash flow. And because you are right there, it is the easiest property to manage.

Conforming loans, Fannie Mae & Freddie Mac. Residential investment properties from one to four units are available. Terms are better if you live in one of the units as your primary residence. It is then considered owner-occupied. If you do not live in the property, the program is priced as an investment property. This comes with higher down payments, interest rates, and more stringent underwriting requirements.

Portfolio lenders. These loans have different terms than government-backed loans or conforming loans. Lenders design these programs on their own. They are available with more flexible, but more costly terms. While flexible, they do conform to real estate law.

Commercial residential rental property loans. Generally, these loans are for properties with 5 or more units. They are intended for larger properties.

Guidelines for investment property mortgages, non-owner occupied

Down payments. A minimum of 20% down payment will be required for better terms, 25% to 30% down will give the best terms.

Landlord experience. Property management or landlord experience can be required for investment properties.

The number of properties. Fannie Mae and Freddie Mac limit the number of properties you can finance to four properties.

Reserves. Lenders want you to have six months of loan payments in reserves for loan payments in case of vacancies.

Credit score. Portfolio lenders will allow lower credit scores. For conforming … A minimum of 640 for lower debt-to-income ratios and lower loan-to-value ratios. Higher ratios require higher minimum scores of 700 or more.

Interest rates. Rates on investment property mortgages are higher. Expect around 0.5% to 1% higher than owner-occupied property loans.

More to know about investment properties

Location. Look for a location with good schools… plus other amenities that will increase the desirability for tenants. Theaters, malls, parks, restaurants are among the services that enhance the property. Also, look for low property taxes. Check the demographics of the area. Determine the likelihood of attracting good tenants.

Know the laws. It is important to be especially aware of landlord-tenant laws. This includes state laws and local laws. Laws can apply to evictions, leases, deposits, and fair housing rules. Are the state and local area more friendly to landlords or tenants?

Be aware of all costs. This includes homeowners insurance … association fees … property taxes … plus other expenses such as landscaping … utilities … garbage pickup … etc. These all apply and may come as a surprise if you have not carefully looked into all expenses. For the best financial safety, work to keep your operating expenses at no more than 50% of the monthly income.

Have a long-term view. Rental property is an investment you need to plan on holding for quite some time. It is not quick to convert back to cash, plus selling too soon means likely selling for a loss. So plan to hold property when you buy it. That makes it critical to know the numbers and investigate before buying.

Know the numbers. Keep emotion out of it and make your decisions based on the logic, on the numbers. Learn the property’s capitalization rate.

Understand how it affects the rate of return. Also, know how your operating expenses compare to the operating income.

Look for great value. Be very wary of overpaying for a property. That can be a major cause of failure with investment property. So look carefully and be diligent to calculate the finances involved. A lower-cost property in a good neighborhood is recommended, not a higher-priced property in a lower cost neighborhood.

Take advantage of the tax benefits. A wide variety of tax deductions will help your potential profitability. These benefits can include mortgage interest … credit card interest used for property expenses … repairs … maintenance … legal fees … property taxes … insurance. A huge tax benefit is the ability to depreciate the purchase price of the property based. This is based on established depreciation schedules. Depreciation provides a tax benefit. It is available even as the property increases in value. (Of course, this is not tax advice, be sure to confirm any tax information with your tax advisor.)

Investment property is your own business. You are in control, and you get to decide how to run your business, within applicable laws. Avoid discrimination and follow fair housing laws. Otherwise, you can choose whom you rent to, what you will charge for rent, how you will run your business. It’s a good way to start going into business for yourself.

Property appreciation. Plan to generate a positive cash flow from the rents on the property. You can also gain from increases in the property value.

Real estate can be a great investment. According to a Gallup poll, more people view real estate as a better investment choice instead of stocks.

Think if you really want to owe money on a rental property. Of course, borrowing money allows you to buy an investment property much sooner. The rate of return calculates to be higher, but it’s riskier. It can be a good plan, but it puts you at greater risk of something going wrong. If you choose to borrow, do everything possible as outlined here to make it as safe as possible.

Invest in landlord insurance. Your homeowner’s insurance policy does not cover all risks. For example, it excludes risks related to renting your property. Here’s more information.

Add saving for emergencies in your projected cash flow. Be sure to have enough extra in your monthly cash flow to save 20% to 30% into an emergency fund. This is for major repairs or emergencies that may come up.

Consider if flipping a property is a good idea. Stories abound of people who buy a fix-up type property, turn it into a rental property and it pays off. But it’s not as easy as it may seem. Chances are high that it could cost more and take longer than you think. It’s not a good idea for your first property. Maybe later when you have more experience.

Get a good accountant. Most likely, you will need professional help with the financial part. A good accountant can help you analyze cash flow. You need someone who is good at managing your tax liability.

Consider the advantages and disadvantages

Finally, weigh these against each other. Decide if investment property makes sense for you.

Possible advantages

Passive income. The goal is for you to receive a monthly income stream without much extra effort. It’s not totally passive, though, because issues can come up that you may need to deal with. Hopefully, those issues will be sporadic and the income will be mostly passive.

Increase in value. Real estate values generally go up over time. Your property’s value should increase as well, assuming that it is well maintained. The value should be more stable than other investments such as the stock market.

Potential tax advantages. Verify these with your tax advisor and attorney. Real estate could be part of a self-directed IRA for possible tax benefits. Rental income can be excluded from Social Security consideration. And the interest on the loan for rental property is tax-deductible. It is an expense of operating the property. (Verify with your tax advisor.)

Real estate is a physical asset. You can see it and touch it. Stocks and other financial products are more intangible.

Possible disadvantages

Dealing with tenants. This is an issue. Then add maintenance and repairs. Both of these can interfere with the otherwise passive nature of rental income.

Potential tax disadvantages. Check with your tax advisor or attorney. If your income is high enough, you may be subject to a surtax on your net investment income. See more here.

Negative cash flow. Problems come if you don’t calculate correctly, or you don’t account for emergencies. Then the property may cost more per month than it brings in. If you don’t have a tenant, you will need to bear all the costs.

Poor liquidity. Real estate generally is not sold quickly. This means it cannot be converted into fast cash if necessary. Stocks can sell quickly in a much more liquid market.

Possible high entry and exit costs. Fixed costs of buying and selling can be high, so getting in and out can be expensive.

In summary

Real estate can be a great investment for the right person and under the right circumstances.

Consider all this, and if you think you qualify and it still looks interesting to you, let’s talk.

Contact your accomplished Real Mortgage Consultant at Winner’s Mortgage. We’ll work together to help you decide whether it makes sense for you. And if it does, we’ll do all we can to help you make investment property possible.